Your Personal Finance Glossary

Welcome to our glossary, where we break down crucial financial terms into simple, clear language. Understanding these concepts is the first step towards making informed decisions about your wealth and future. Let's embark on this journey together and empower yourself with knowledge.

Clear Answers. Powerful Understanding.

You won’t find vague buzzwords or dry textbook definitions here. Instead, you’ll get:

•Real-world examples

•Practical context

•Strategy-based insights

So you can make sense of every piece of the plan.

Made for Real People

Not Wall Street Pros

Every entry is written in plain English

and designed to give you instant clarity.

What is a life insurance investment?

A life insurance investment is a financial product that combines insurance coverage with the potential for growth. It allows you to secure your family’s financial future while also using your policy as a long-term investment tool.

How does this type of strategy work?

This strategy leverages the cash value of your life insurance. As you pay premiums, part of your money accumulates and can be accessed for investments or emergencies, providing both security and growth.

What are the benefits of these investments?

These investments offer unique tax advantages, death benefits, and potential for cash value growth. They can be tailored to fit your financial needs and goals, making them an appealing choice for many.

Is it suitable for everyone?

While life insurance investments can be beneficial, they may not fit every financial situation. It’s important to assess your goals and needs, and consulting with a financial advisor can help clarify if it’s right for you.

These terms are just the beginning.

Dive deeper into the full glossary

to build total confidence in your wealth strategy.

Start Exploring

the Full Glossary

Browse All Terms →

FAQ

Understanding Financial Insights

Our glossary is designed to help you navigate the often complex world of finance. By breaking down terms and concepts, we aim to enhance your financial literacy, empowering you to make informed choices about your wealth and future.

Why Financial Literacy Matters

Being financially literate is key to achieving long-term security. Our resources aim to clarify financial concepts, making them accessible so you can confidently plan for your future, whether for yourself, your family, or your business. Book A Discovery Call.

Explore Key Financial Terms

Welcome to our glossary of essential financial terms. Here, you’ll find clear definitions and practical examples to help you navigate the world of finance. Whether you’re planning your family’s future or structuring your investments, this resource is designed to empower you with knowledge.

Unlock Your Financial Future Today

Ready to take the next step in your financial journey? We offer a range of resources designed to help you better understand wealth strategies. Explore our educational materials and discover how you can empower yourself and your family with informed financial decisions. Let’s build your legacy together! Start Here.

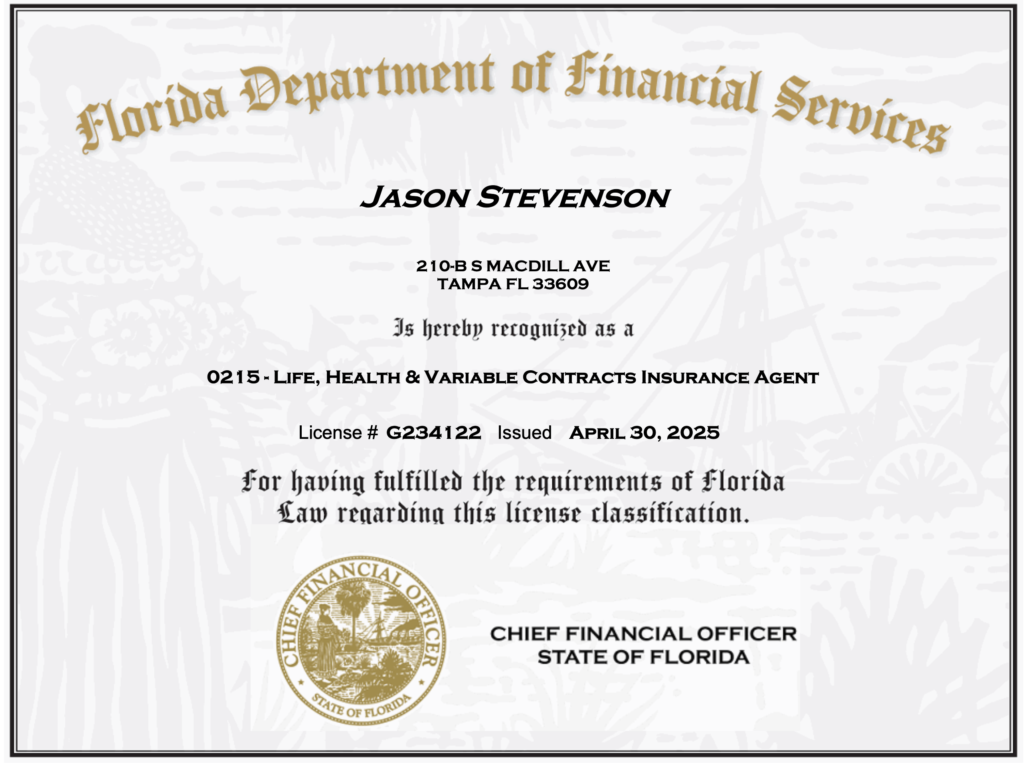

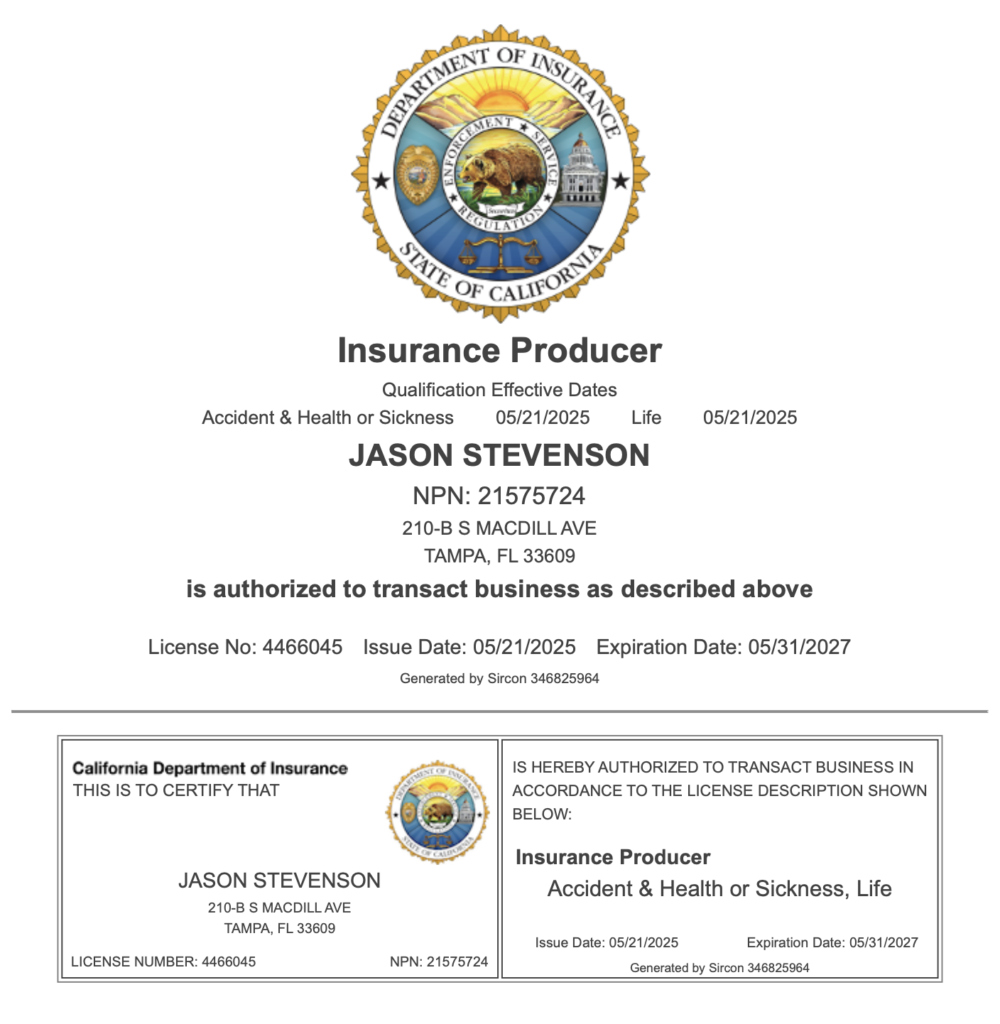

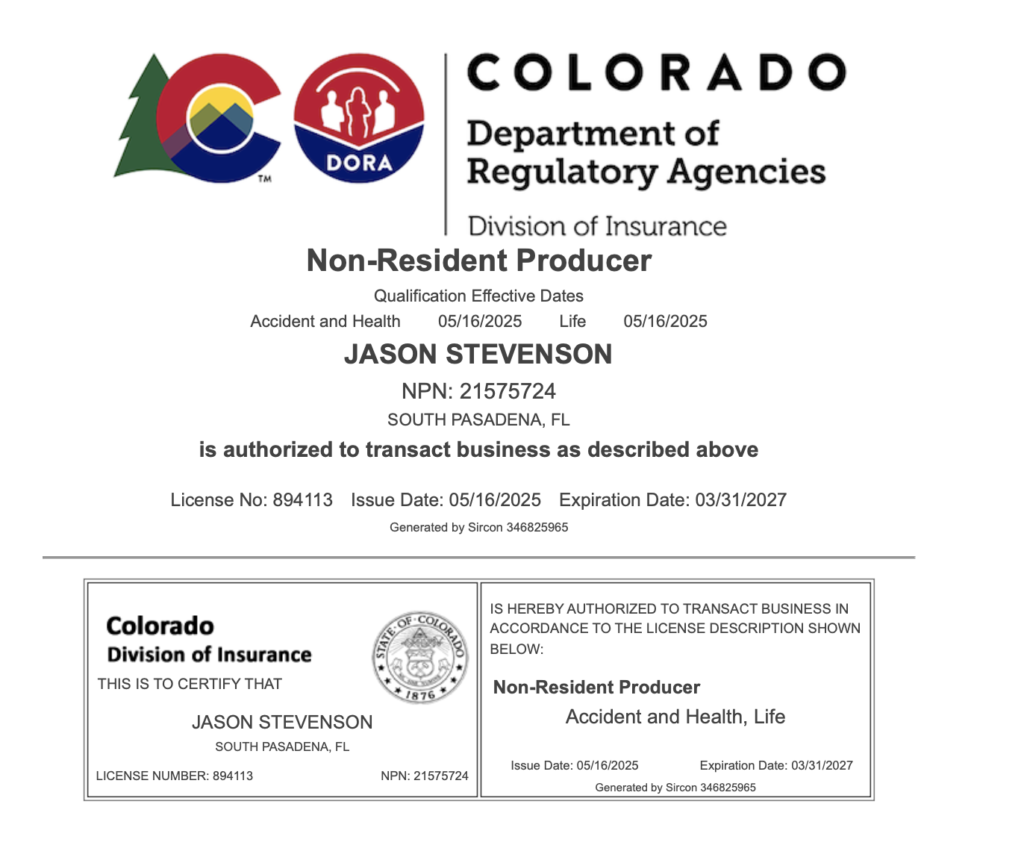

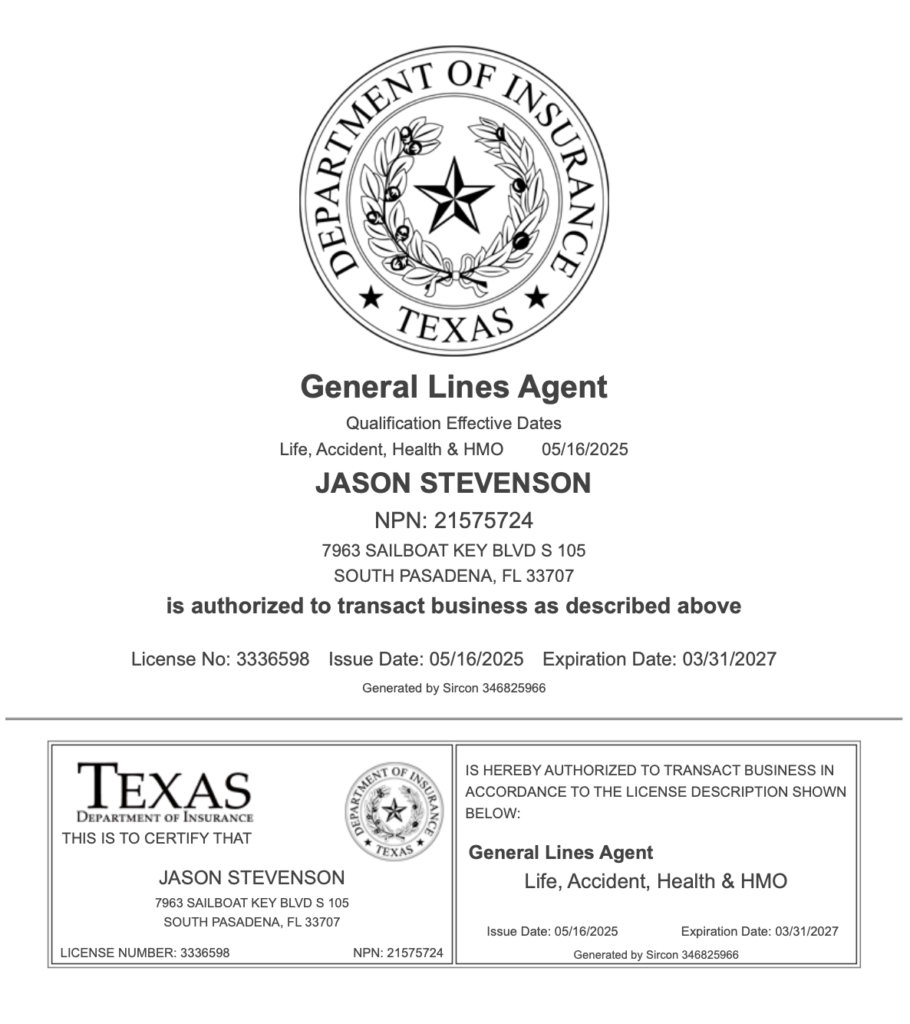

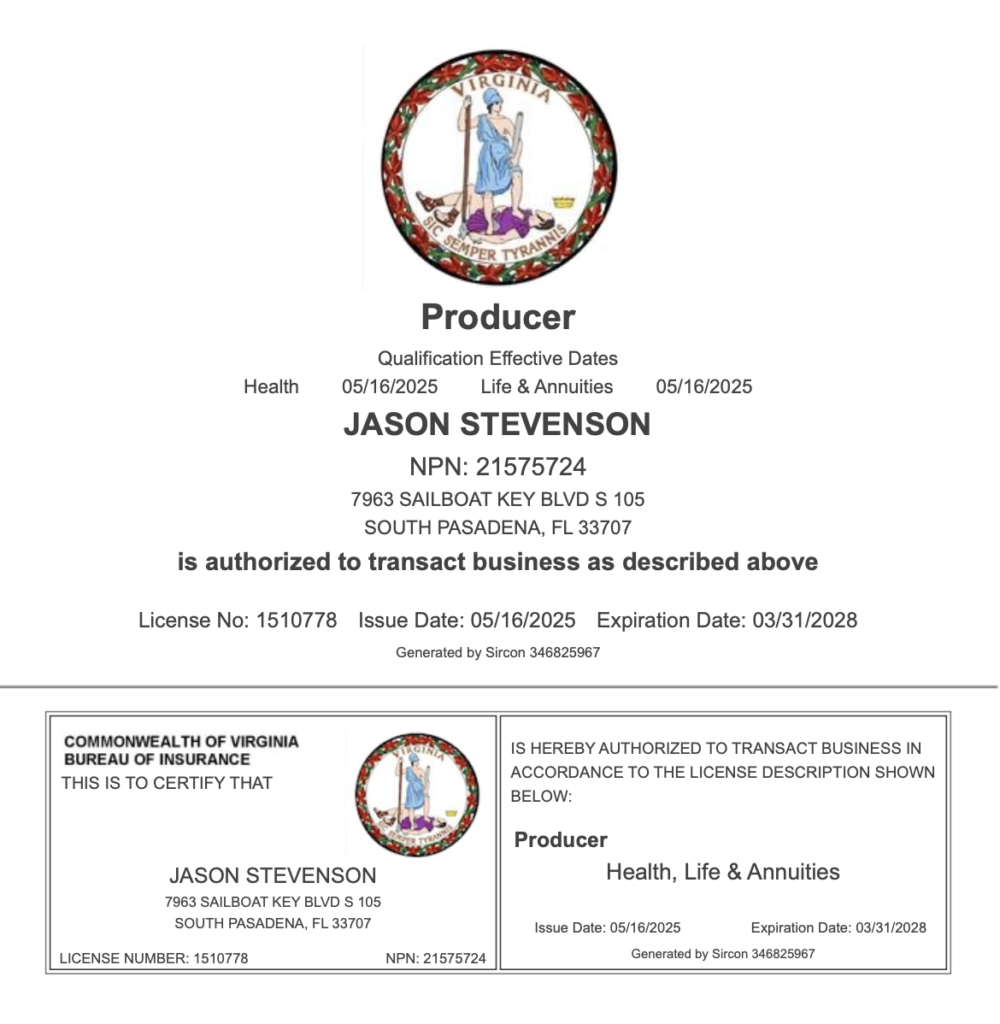

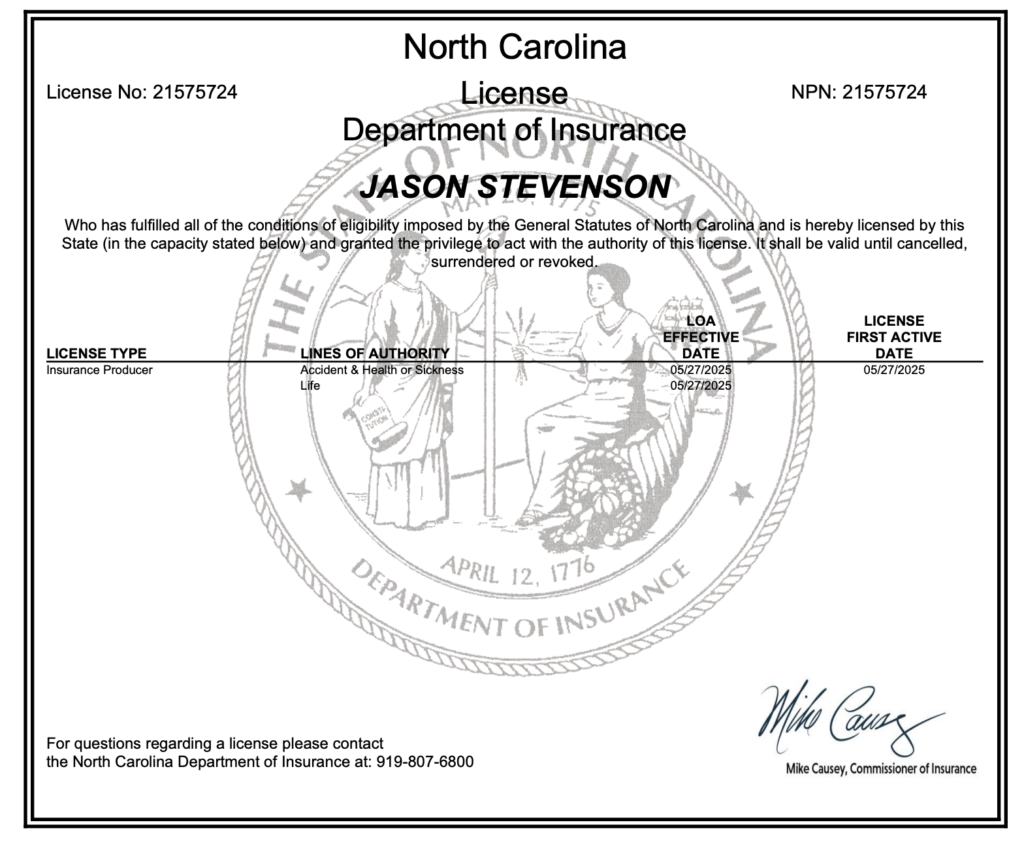

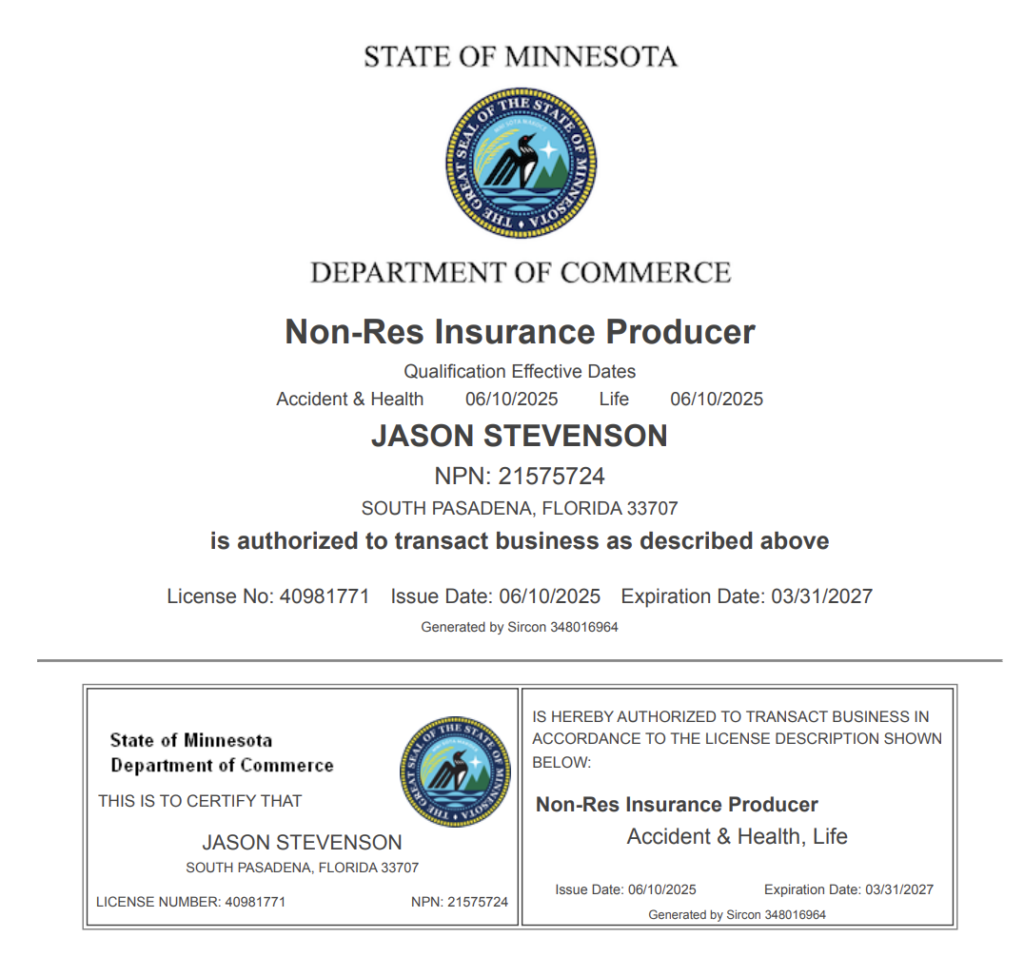

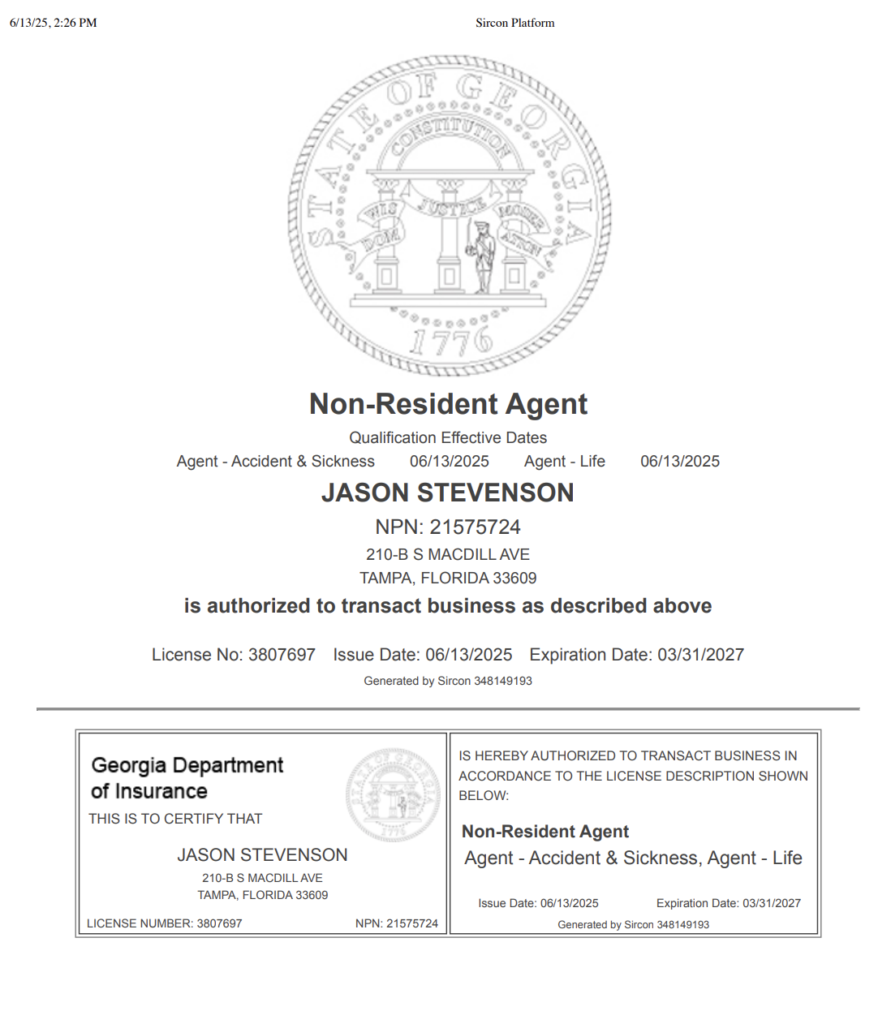

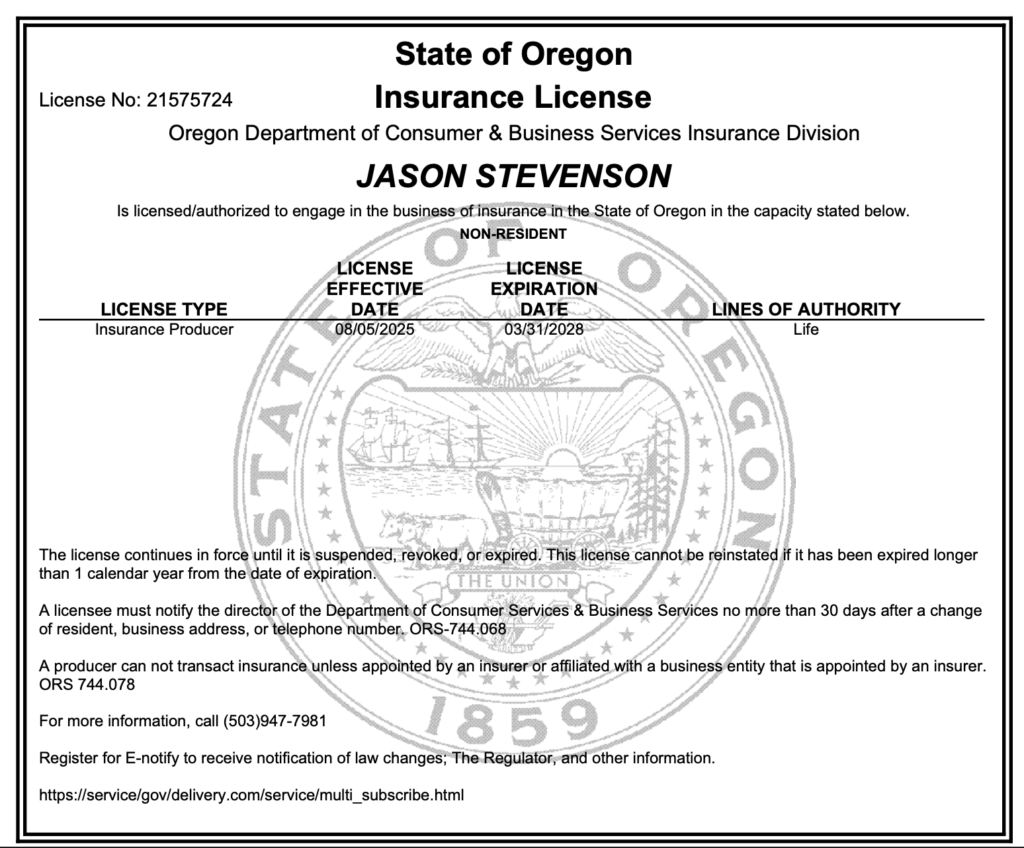

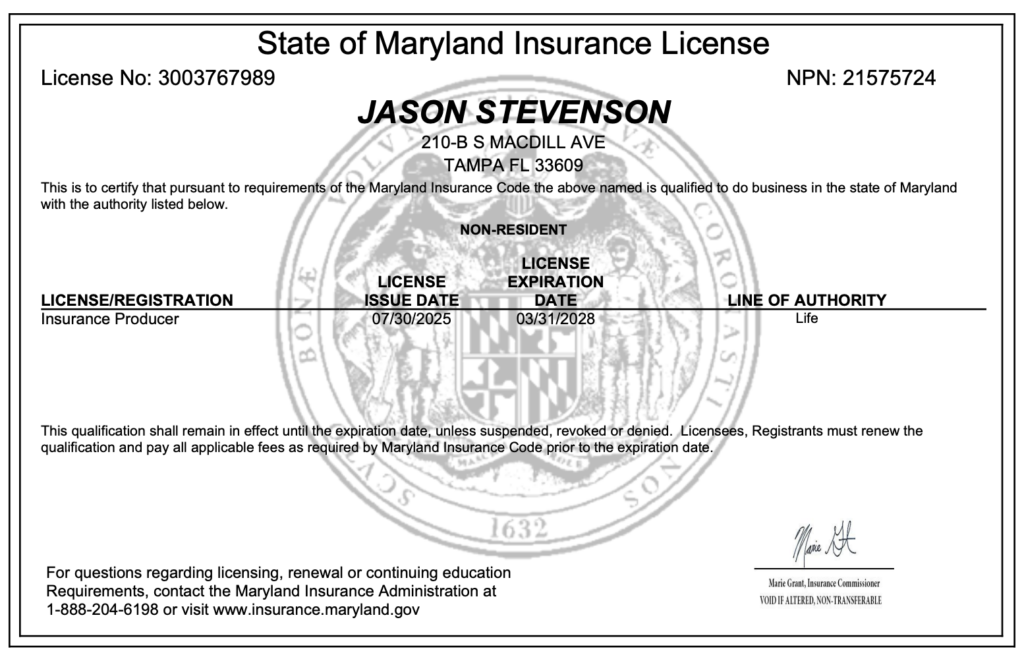

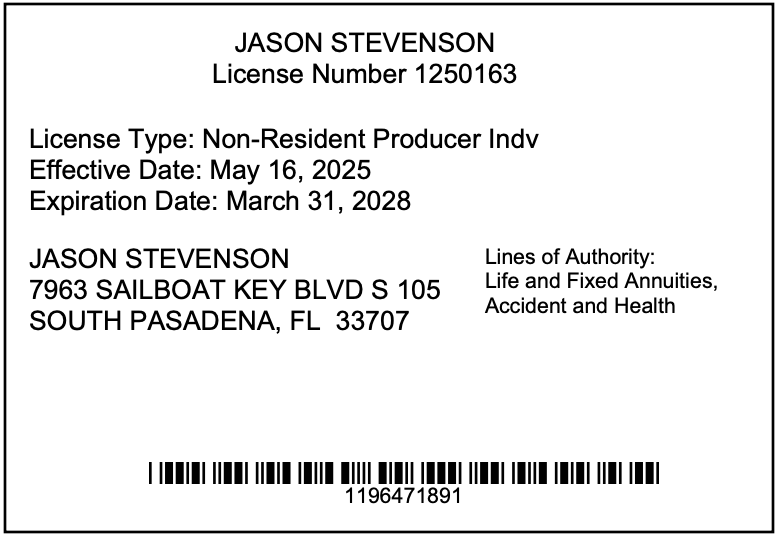

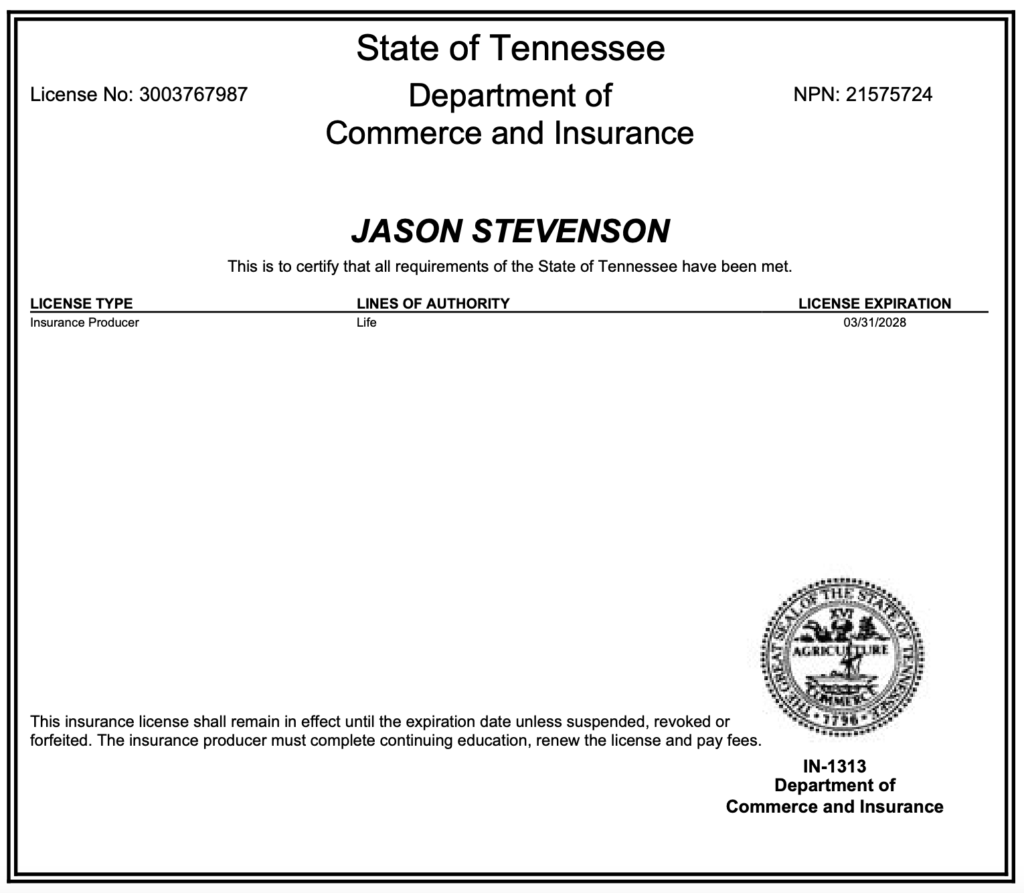

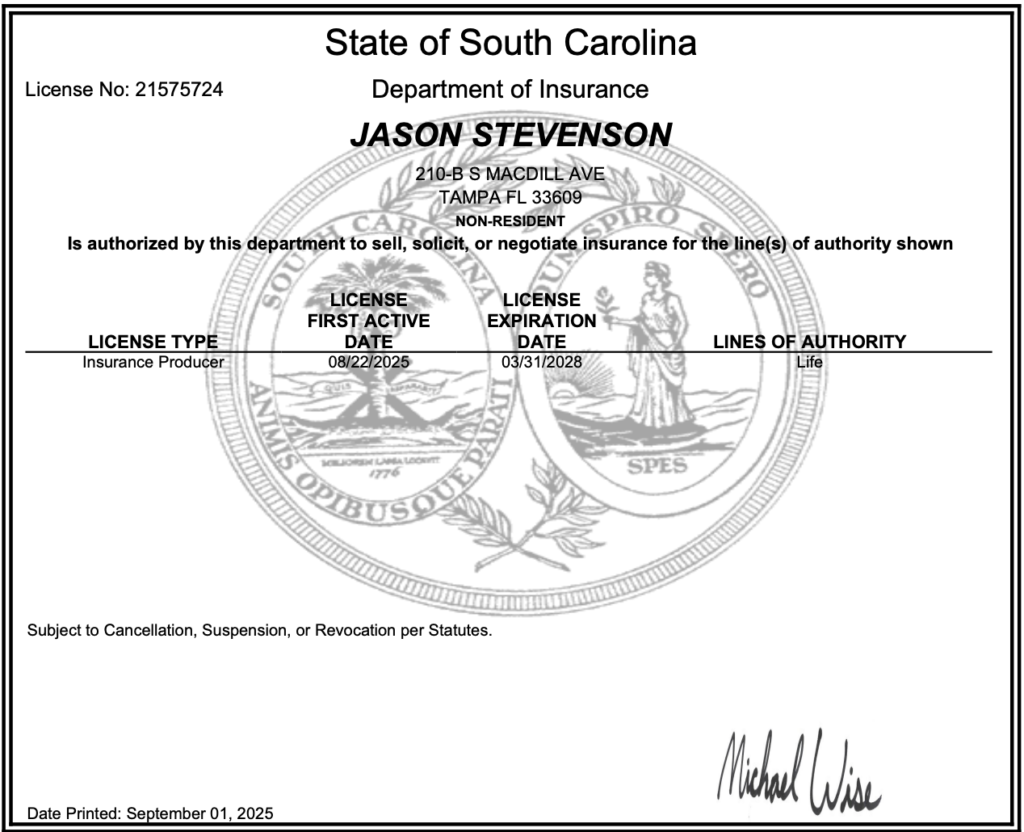

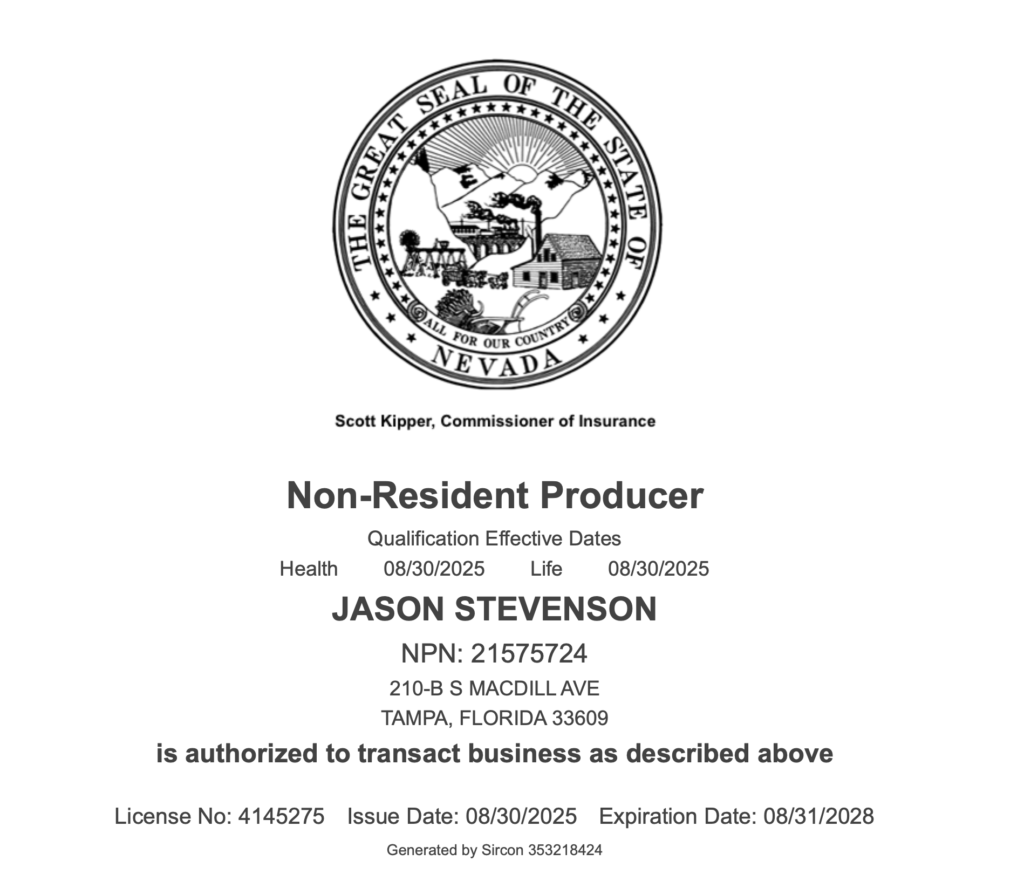

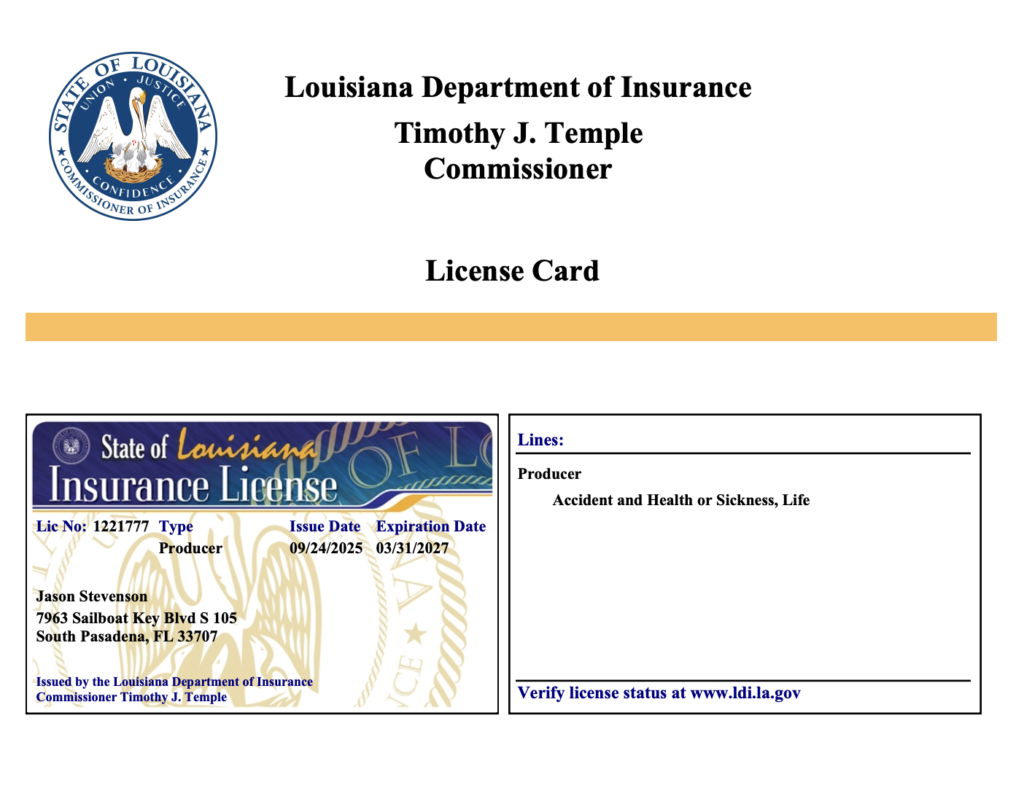

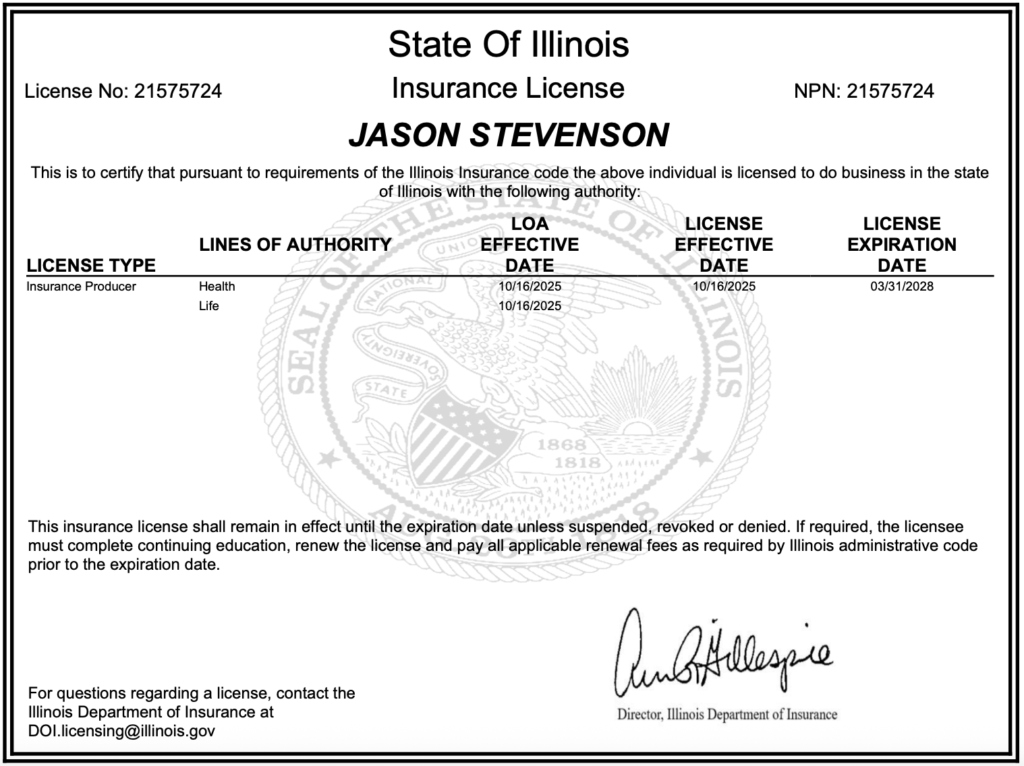

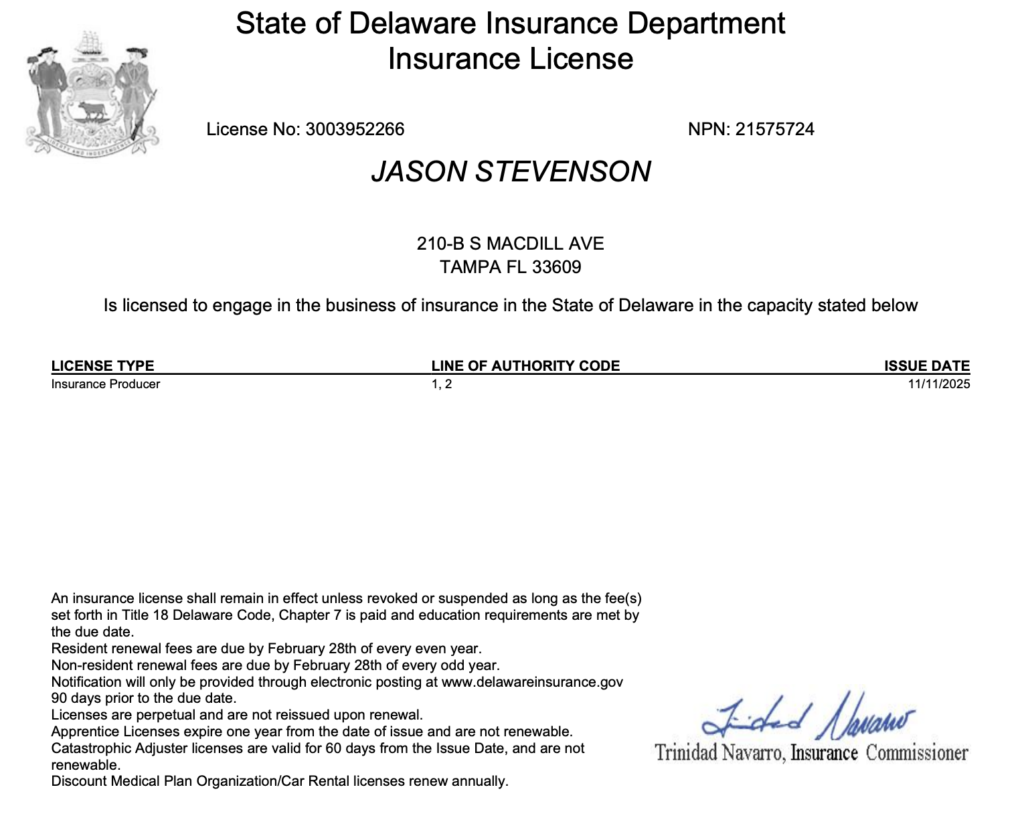

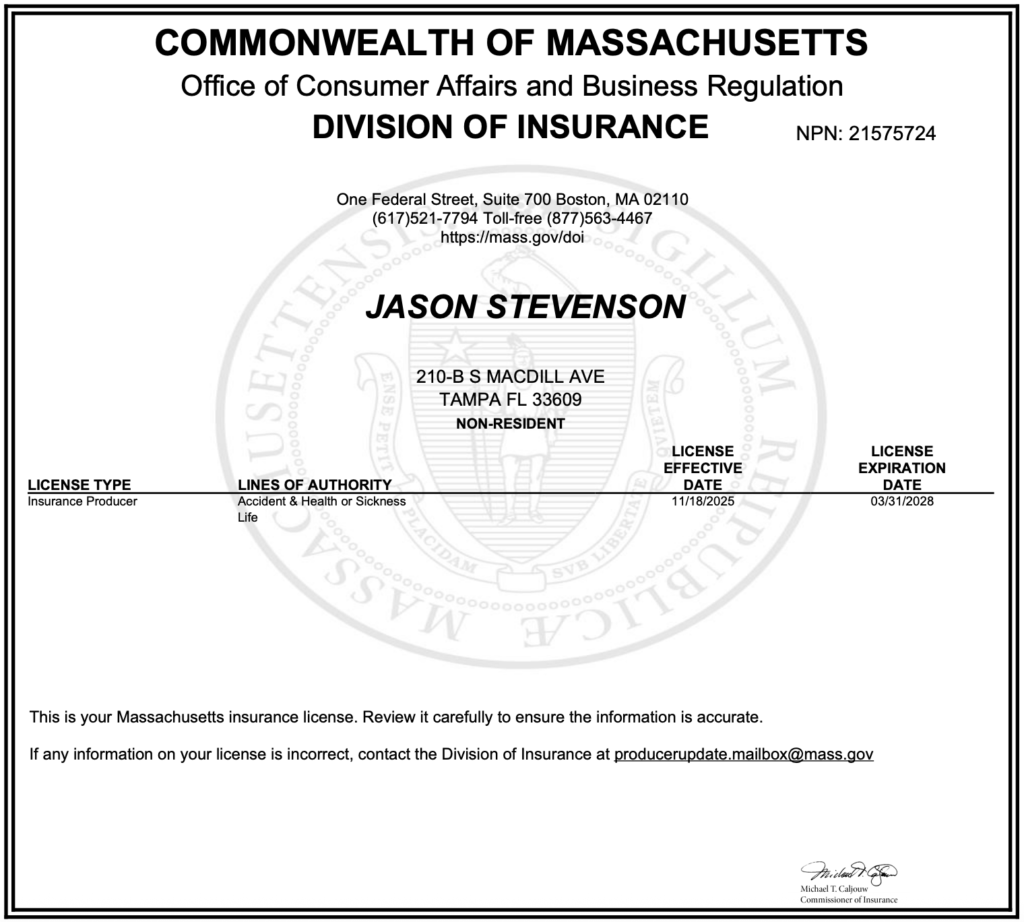

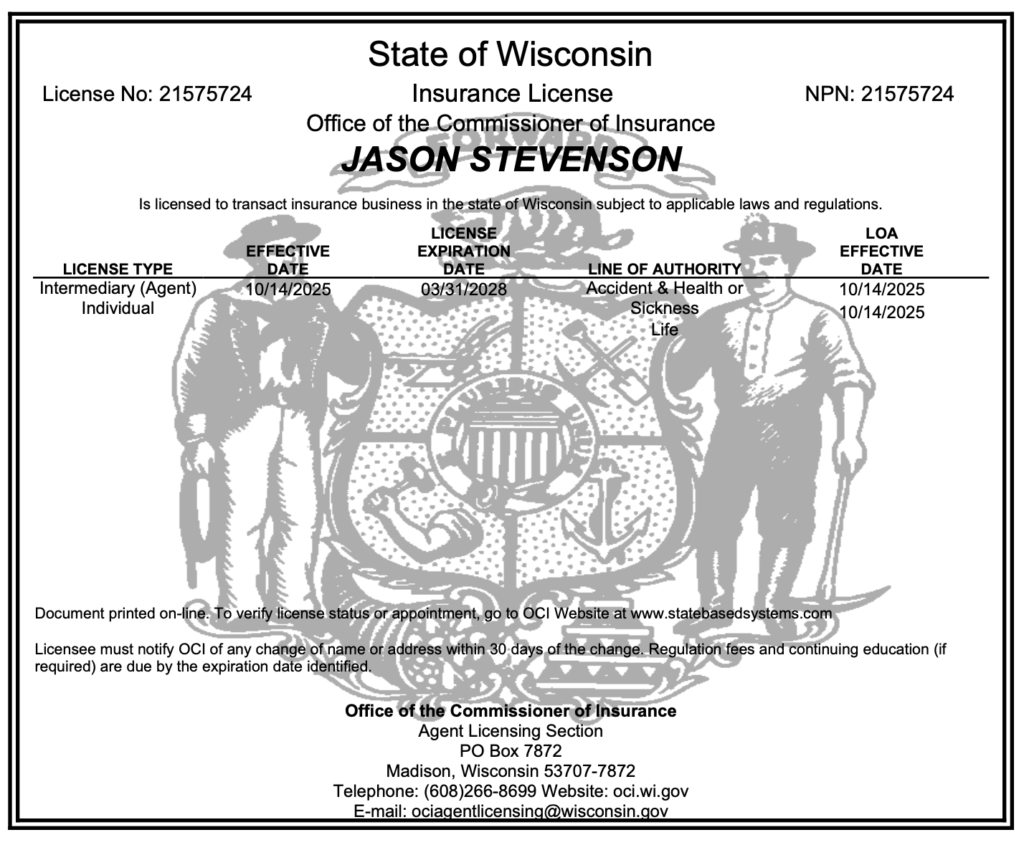

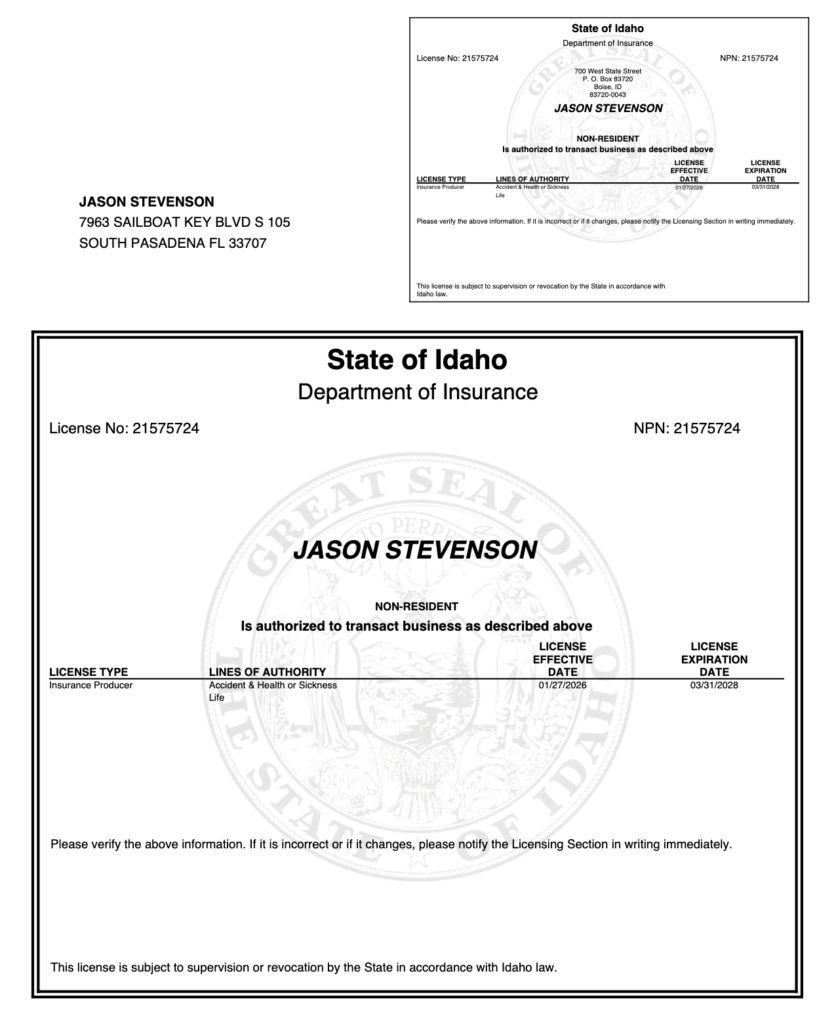

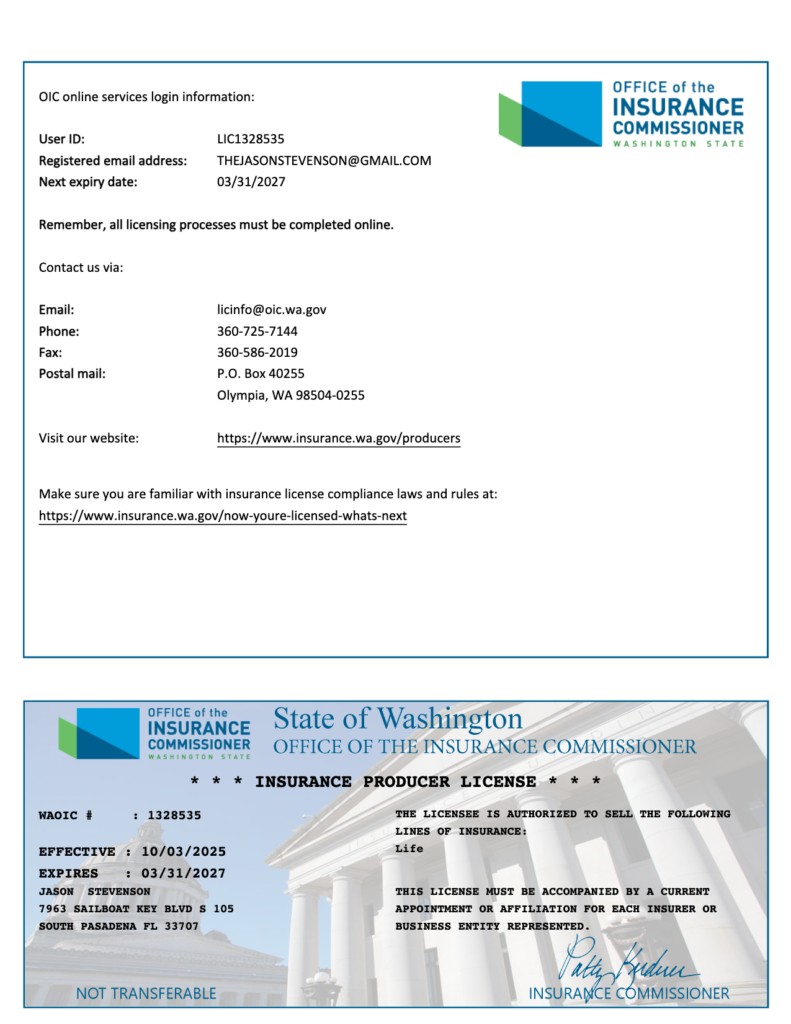

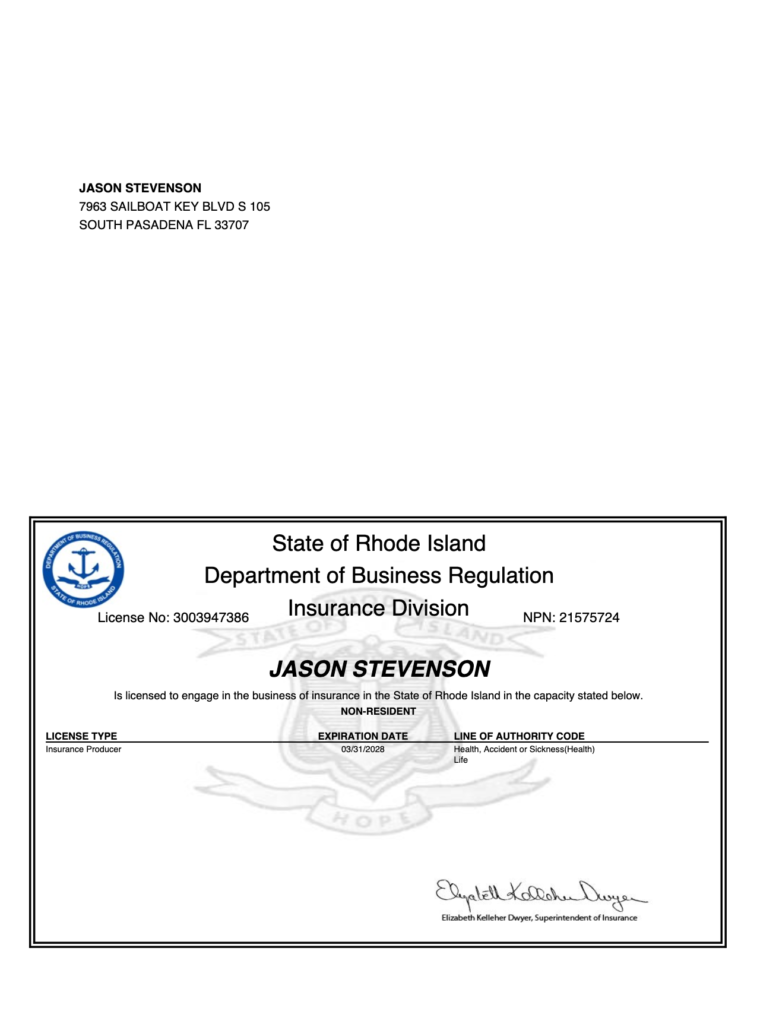

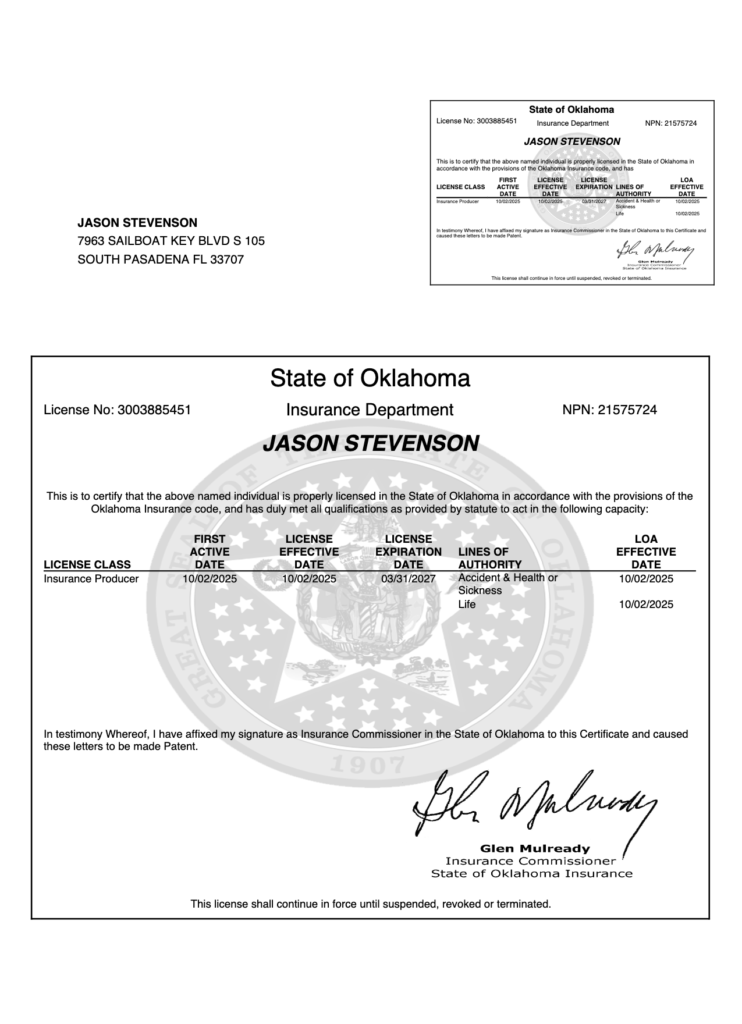

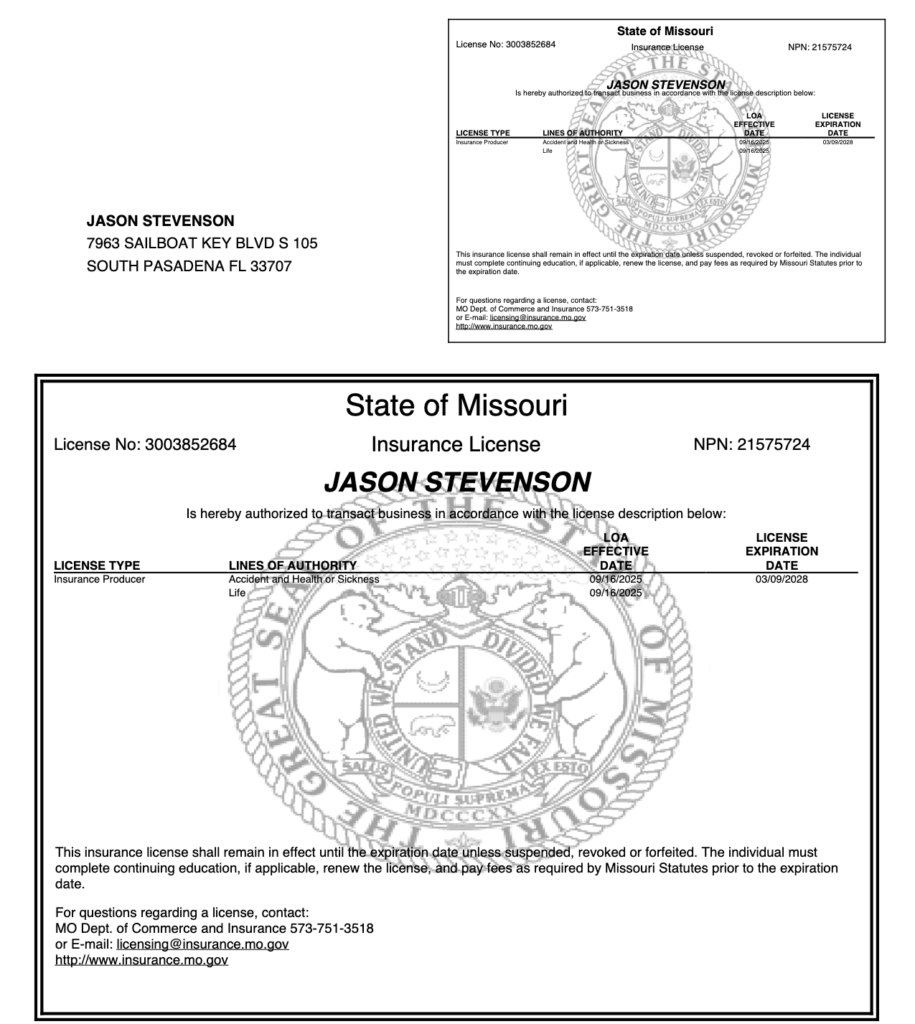

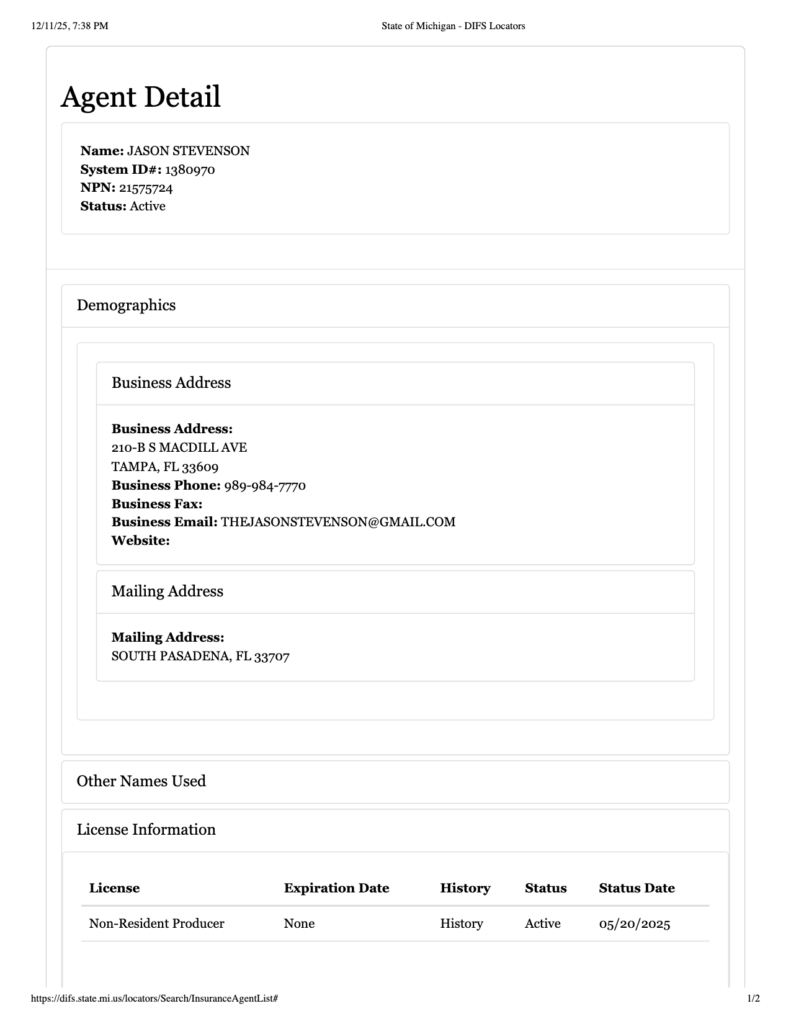

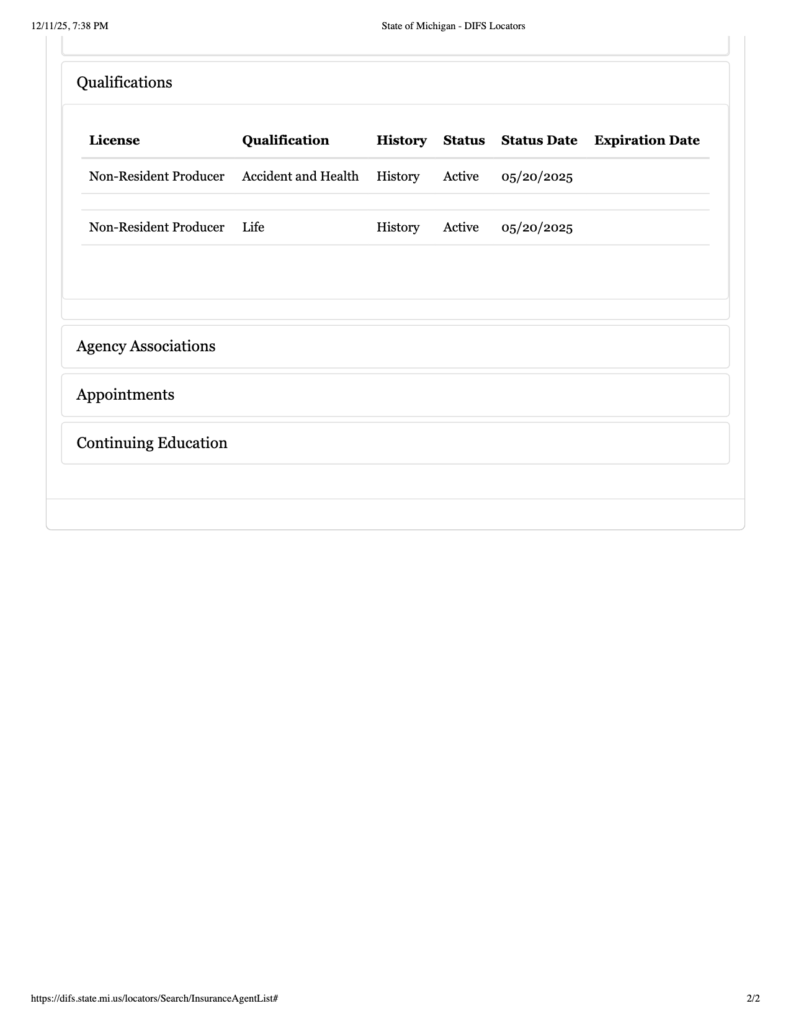

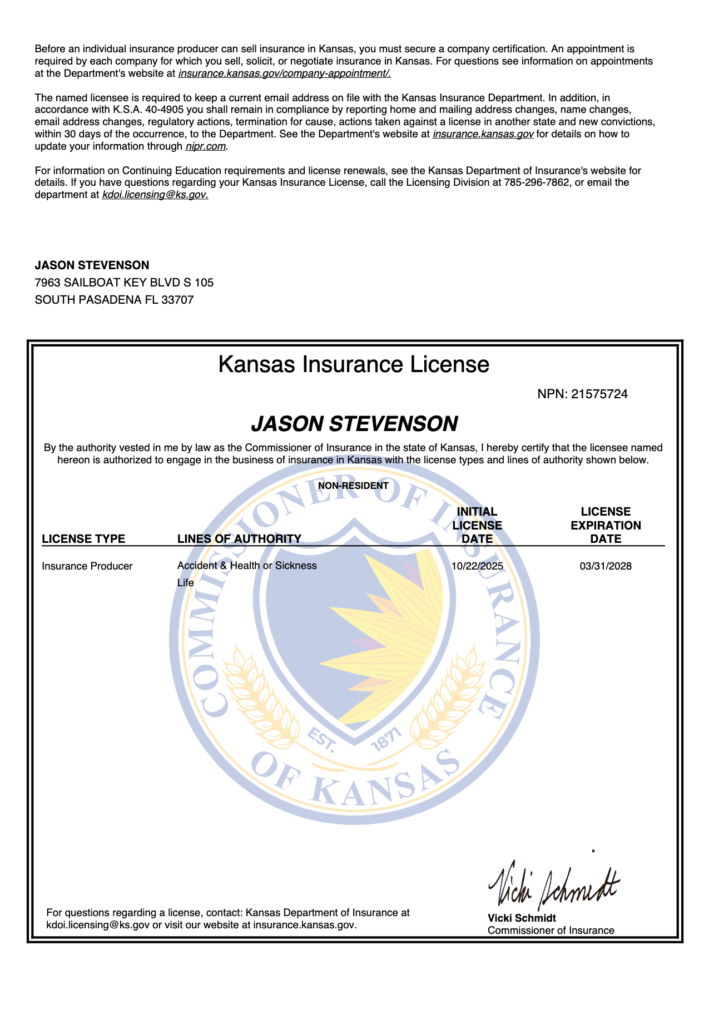

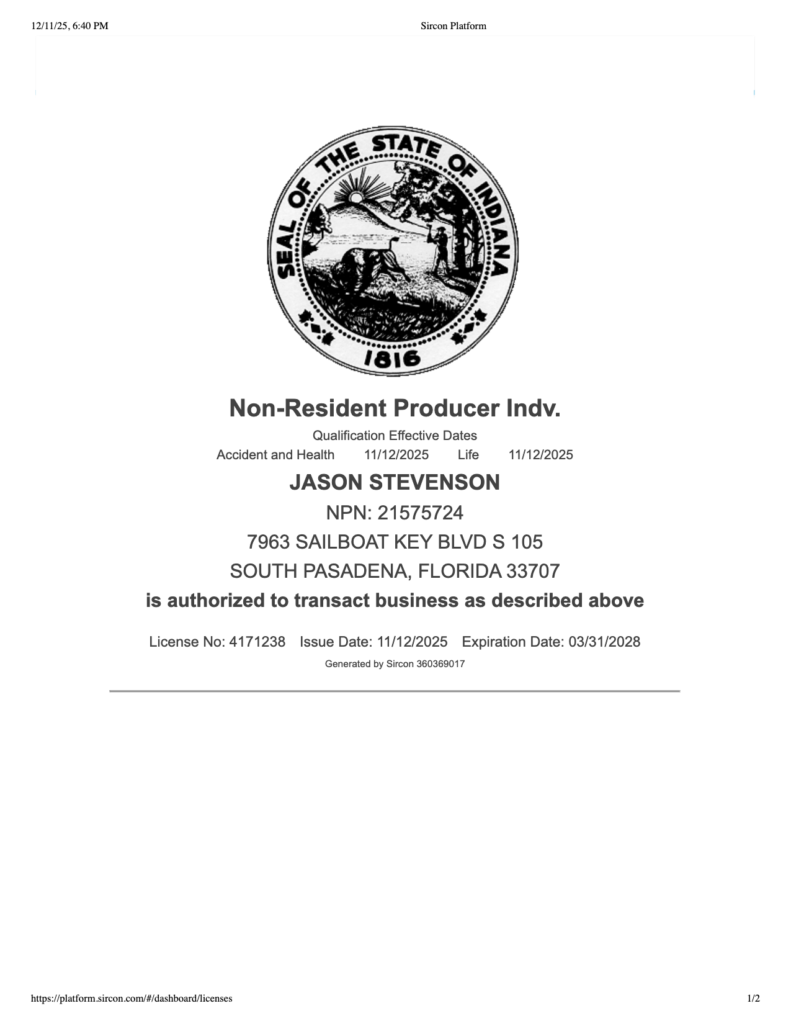

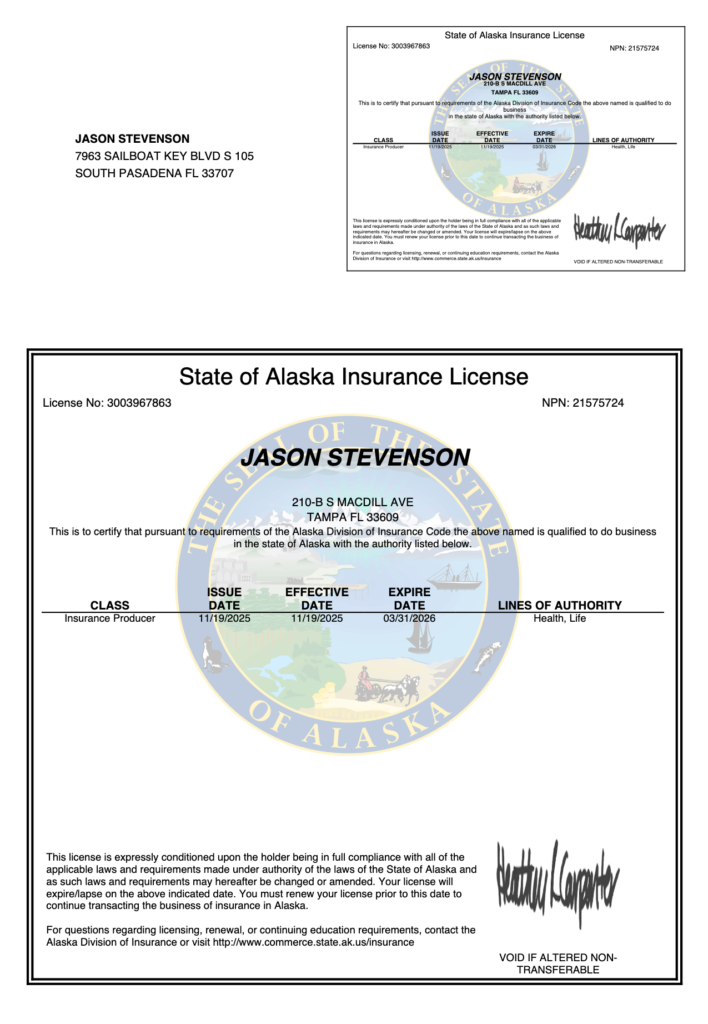

Who will I be talking with?

You can expect an automated voice prompt from a robot to walk you through a 17-step menu… just kidding. You’ll hear directly from Jason or someone from our small, dedicated team. No call centers. No outsourcing. Just real people who care, and can get you what you want. If you want the best help, and prefer sooner than later, Start Here.

Do you only work with high-income earners?

Not at all. We work with professionals at many stages. What matters most is that you’re ready to think differently about how your money works for you

If you want to get a head start, Start Here.

Ready to Apply What You’ve Learned?

Book a call and see how your strategy fits together in real time. Our team is here to answer every question—and show you what’s possible.